Navigating the Investment Landscape: Stocks Vs. Bonds Vs. Mutual Funds Vs. ETFs

You're on a journey through the financial jungle, where choices abound and the path isn't always clear. Stocks offer a slice of ownership, while bonds lend a steadier hand. Mutual funds mix it up with a cocktail of options, and ETFs streamline the process with a single purchase. Don't get lost in the thicket of terms; let's break down these investment vehicles, so you can navigate the landscape with confidence and clarity.

Key Takeaways

- Stocks represent ownership in a company and offer the potential for higher gains but also come with greater risk.

- Bonds provide a more predictable form of investment with steady income and less chance for significant earnings.

- Mutual funds offer diversification, professional management, and the goal of growing wealth but come with higher fees.

- ETFs combine the flexibility of stocks, the diversification benefits of mutual funds, and lower fees compared to mutual funds.

Understanding Stocks

Stocks represent a share of ownership in a company, allowing you to partake in its profits and growth. When you buy a stock, you're hoping the company does well. If it does, the stock's price usually goes up. But there's a catch: stock volatility. This means the stock's price can change a lot in a short time. It's like a roller coaster - it can be up one day and down the next.

You've got to be ready for this ride. Some people use dividend strategies to make it smoother. Companies sometimes pay dividends to shareholders from their profits. By focusing on stocks that pay dividends, you can get regular payments. It's like getting a little thank you note for investing in the company.

But remember, not all stocks pay dividends. And even those that do can stop if the company hits a rough patch. So, you've got to think about what works for you. Are you okay with the ups and downs? Do you want those dividend checks?

Now, let's shift gears and talk about bonds. They're a different kind of investment. Less roller coaster, more steady climb. Let's see how they fit into your investment plan.

The Role of Bonds

Bonds offer you a more predictable form of investment, typically providing regular interest payments and the return of principal at maturity. They're a safer bet than stocks, but you need to know a few key points:

-

Bond Liquidity: Bonds can be easier to sell than other investments. That means you can usually get your money out if you need it. However, some bonds are more liquid than others. It's something to check before you buy.

-

Inflation Impact: Over time, rising prices can eat into your bond earnings. If inflation is high, the money you get back might buy less than you'd hoped.

-

Risk and Return: While bonds are generally less risky than stocks, they also tend to offer lower returns. You're trading some potential profit for a smoother ride.

Remember, no investment is perfect. Bonds have their ups and downs, just like anything else. But they play a key role in balancing your portfolio. They can help you steady the ship when the stock market gets choppy.

Now that you've got a handle on bonds, let's take a step further and dive into exploring mutual funds.

Exploring Mutual Funds

When considering your investment options, mutual funds offer a way to diversify your portfolio with a single transaction. You pool your money with other investors. A professional manager picks stocks, bonds, or other assets. This is called active management. It can help you if you're not sure what to buy.

Fund fees are important. They can eat into your returns. Look for low-cost funds. They can save you a lot over time.

Here's a simple table to help you picture mutual funds:

| Feature | Detail |

|---|---|

| Diversification | Many assets in one purchase |

| Management | Professional oversight |

| Fund Fees | Costs that reduce returns |

| Investment Goal | Grow wealth over time |

Mutual funds can be smart for long-term goals. They're not as simple as they might seem, though. You've got to watch the fees and see how the fund does.

Now, let's shift gears and start decoding ETFs. They're another tool you can use. They're similar to mutual funds but have their own perks.

Decoding ETFs

In the realm of investment options, you'll find that ETFs, or Exchange-Traded Funds, offer the flexibility of stocks with the diversification benefits of mutual funds. As a hybrid, ETFs have grown in popularity for a few key reasons:

- ETF Liquidity: You can buy and sell ETFs throughout the trading day, just like stocks. This means you're not locked in until the market closes.

- Low Costs: Generally, ETFs come with lower fees compared to mutual funds, letting you keep more of your money.

- Index Tracking: Many ETFs aim to track the performance of a specific index, such as the S&P 500, providing a straightforward approach to mimicking market returns.

With ETFs, you're getting a basket of investments that trade on an exchange. They can include stocks, bonds, commodities, or a mix. ETF liquidity ensures that you can react quickly to market changes. Plus, index tracking allows for a passive investment strategy, aligning your portfolio with market benchmarks without the need to pick individual stocks.

As you consider your options, it's crucial to compare the benefits and drawbacks of each investment vehicle. Let's dive into that in the next section.

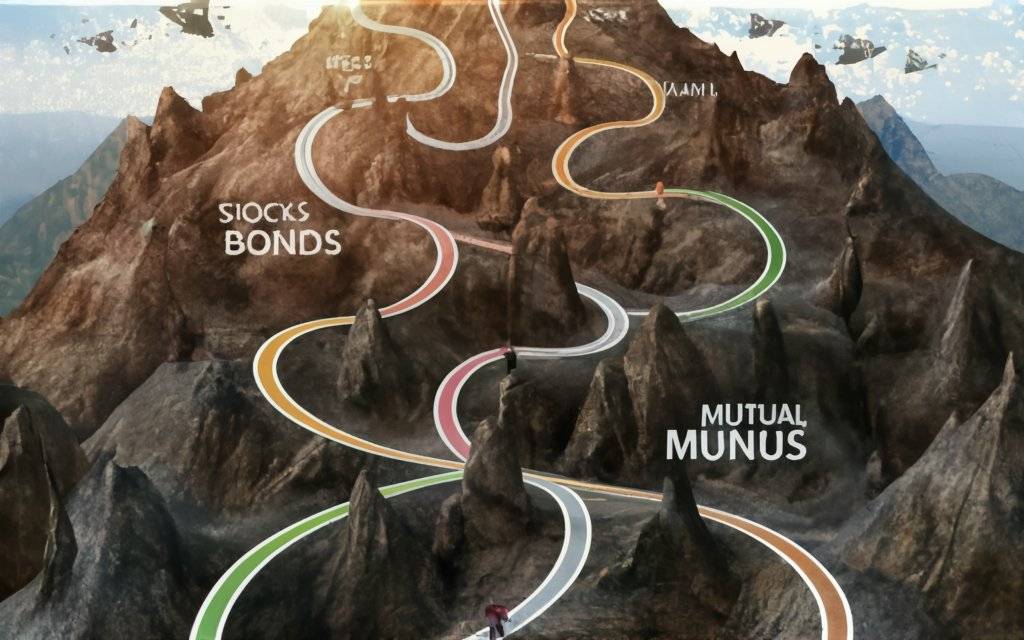

Comparing Investment Vehicles

As you evaluate your investment choices, it's essential to weigh the distinct features and potential risks of stocks, bonds, mutual funds, and ETFs. Stocks offer ownership in a company. They can grow fast but also fall hard. Your risk appetite matters here. If you're okay with ups and downs for bigger gains, stocks might fit you.

Bonds are loans you give to companies or governments. They're safer than stocks, usually. You get steady income from them, but with less chance to earn big. They can balance your risk and add steady growth.

Mutual funds pool your money with others to invest in many stocks or bonds. They're managed by pros who pick and choose for you. This means more diversification, spreading out your risk. But, you'll pay fees for this management.

ETFs are like mutual funds but trade like stocks. They let you buy a bunch of investments in one go, often with lower fees than mutual funds. They offer portfolio diversification and can be a smart choice if you want to keep costs down and manage your own risks.

Think about your comfort with risk and your need for growth or income. Each choice has its own balance of risk and potential reward. Choose what helps you meet your goals.

Conclusion

As you weigh your options, think of a garden. Stocks are individual plants, growing at their own pace. Bonds are the soil, steady and supportive. Mutual funds? They're the variety packs, a mix of seeds. And ETFs? They're your ready-made planters, easy to swap in and out. Each has a role, each offers a balance. It's your garden—choose the mix that'll help it flourish. With care and attention, your financial landscape can thrive.

0 Comments: