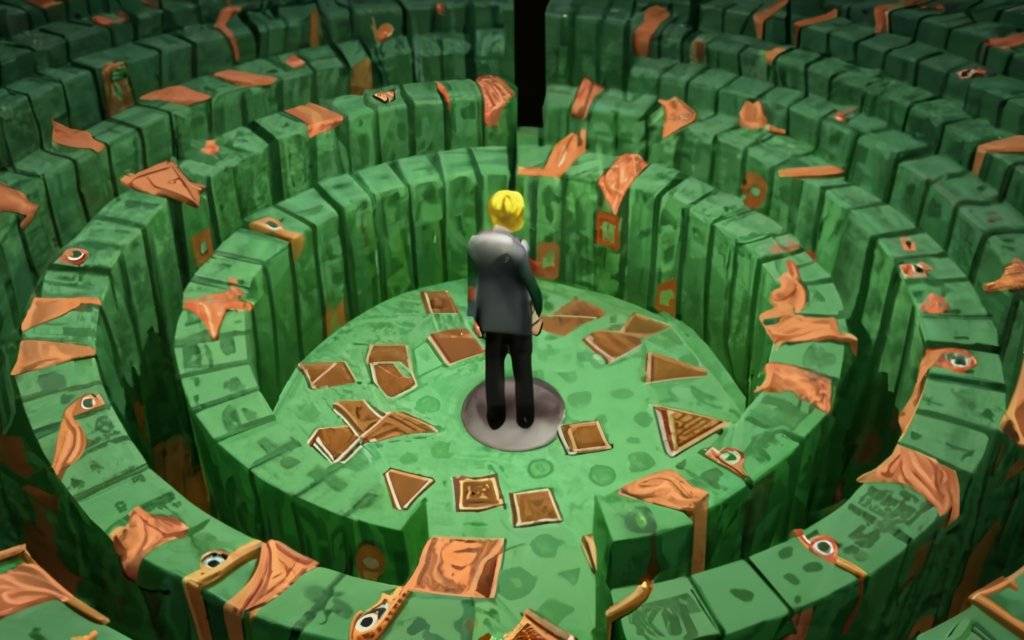

Conquering the Investing Labyrinth: A Step-by-Step Guide to Confident Investing

You're standing at the entrance of a maze—hedged in by daunting financial decisions and complex investment paths. But here's the thing: you've got the map. This step-by-step guide is your blueprint to navigate the twists and turns of the investing labyrinth. Each chapter builds your confidence, from laying down a solid foundation to skillfully adjusting your strategies. So lace up your shoes—it's time to transform from a hesitant newcomer to a savvy investor. Let's dive in!

Key Takeaways

- Understand your risk tolerance and assess your financial situation

- Define clear financial targets and investment goals

- Balance risk and rewards through asset allocation and diversification

- Stay calm and focused during market volatility, and regularly monitor and adjust your investments

Assessing Your Financial Landscape

Before you navigate the twists and turns of investing, you'll need to take stock of every aspect of your financial situation. It's like setting out on a treasure hunt, where understanding your own map is key to success. First, let's chat about your risk tolerance. Think of it as your financial comfort zone. Are you the adventurous type, ready to ride the market's roller coasters? Or do you prefer a leisurely stroll through the park, with safer, more predictable paths? Knowing this helps you avoid biting your nails every time the market wiggles.

Now, what about your investment goals? These are your financial targets, the milestones you're aiming for. Are you saving for a sun-soaked retirement, a kiddo's college fund, or maybe a shiny new car? Your goals will shape your investing strategy, so it's crucial to define them clearly.

Building Your Investment Foundation

Having mapped out your goals and risk tolerance, it's time to build your investment foundation, ensuring your financial strategy stands on solid ground. Think of this as your financial blueprint, where every brick matters and each layer supports the next.

Your foundation starts with understanding the basics. Let's break it down in a simple table:

| Element | Description | Why It Matters |

|---|---|---|

| Investment Goals | What you want to achieve financially | Guides your investment choices |

| Risk Tolerance | How much risk you can stomach | Prevents biting off more than you can chew |

| Asset Allocation | Distribution of investments across types | Balances risk and rewards |

Investment goals are your destination, risk tolerance is your comfort speed, and asset allocation is the route you take. You wouldn't speed down a highway in heavy rain, right? So don't overload on risk if it's going to keep you up at night.

Remember, your foundation needs to be strong enough to support your dreams without crumbling under pressure. Once you've got this down, you're well on your way to confident investing.

Ready for the next step? Let's roll up our sleeves and dive into developing a strategic portfolio.

Developing a Strategic Portfolio

Determination is key as you sculpt your strategic portfolio, aligning investment choices with your unique financial landscape. You've got to consider your risk tolerance – that's your comfort level with the ups and downs of the market. It's like knowing how spicy you like your food; too much and you're uncomfortable, too little and you're bored.

Let's break it down with these must-haves:

- Understand Your Risk Tolerance: Gauge how much market volatility you can stomach without losing sleep.

- Mix It Up: Employ diversification strategies to spread risk across various investment types.

- Stay Agile: Be ready to adjust your portfolio as your life goals and the market change.

Diversification strategies are your best pals in the investing game. Think of your portfolio as a team, each player with a unique role, working together to win the championship – your financial goals. You wouldn't want a team full of quarterbacks, right? Mixing stocks, bonds, and other assets can help balance your risk and keep you in the game for the long haul.

Navigating Market Volatility

As you diversify your investments, you'll also need to master the art of weathering market volatility, an inevitable part of every investor's journey. It's all about staying calm and collected—building your emotional resilience is key. But hey, don't just take my word for it. Let's break it down in a way that sticks.

| Volatility Factor | Your Game Plan |

|---|---|

| Sudden market drop | Don't panic-sell; keep long-term goals in mind. |

| Unexpected spike | Resist the urge to chase; assess if it aligns with your strategy. |

| News-induced swings | Tune out noise; focus on credible data and analysis. |

| Economic shifts | Review and understand how these could impact your portfolio. |

| Personal risk tolerance | Adjust your holdings to what you can comfortably withstand. |

See? It's not about avoiding the ups and downs; it's about how you ride them out. It's normal to feel a bit queasy when the market does a loop-de-loop, but remember, your risk tolerance is your safety harness.

Now, let's glide into the next step: monitoring and adjusting investments. You're in the pilot seat, after all, and a smooth flight calls for some savvy maneuvers.

Monitoring and Adjusting Investments

You'll need to regularly review your portfolio to ensure it aligns with your evolving financial goals and market conditions. It's like checking your map to make sure you're still on the right path. Here's the deal: as life changes, so does your risk tolerance. Maybe you're getting closer to retirement, or perhaps you've just welcomed a new family member. Whatever the case, your investments need to adapt.

Here's a quick rundown:

- Stay Alert: Keep an eye on the performance of your investments. Are they meeting your expectations?

- Balance is Key: Make sure your asset allocation hasn't strayed from your intended path.

- Adjust the Sails: When necessary, rebalance to get back to your ideal investment mix.

Investment rebalancing is like tidying up—it might not be the most exciting task, but it's crucial for long-term success. If you've got too much in one area, you might be taking on more risk than you bargained for. Conversely, playing it too safe could mean missing out on growth opportunities. Keep tweaking, keep tuning, and you'll stay on course to reach your financial destinations.

Frequently Asked Questions

How Do Tax Considerations Impact My Investment Choices and Returns?

Tax considerations can make or break your investments. You've got to think about tax efficiency and deduction strategies to maximize returns. Don't let taxes sneak up on you—plan ahead and keep more cash!

What Role Does Ethical or Socially Responsible Investing Play in My Investment Strategy?

You'll face ethical dilemmas choosing stocks. Pondering the impact of your investments? It's about aligning your values with your strategy. Measure that impact and see how it feels. You're shaping the future!

How Can I Incorporate Alternative Investments Like Cryptocurrencies or Commodities Into My Portfolio?

You're eyeing crypto and gold, aren't you? To blend them into your portfolio, you'll need a sharp risk assessment and a diversification strategy. Think of them as spice—just the right amount enlivens the mix!

What Strategies Exist for Investing During Periods of Hyperinflation or Economic Recession?

You're facing hyperinflation or a recession? Consider inflation-indexed bonds to hedge against price spikes. Don't put all your eggs in one basket; portfolio diversification's key! How's your mix looking?

How Should I Approach Investing if I Am Planning to Emigrate or Retire in a Different Country?

You're moving abroad, right? Tackle currency risk head-on; it'll affect your savings. And hey, don't forget to check those retirement visas—make sure your investments align with your sunny beach or mountain retreat plans!

Conclusion

You've journeyed through the financial maze, from groundwork to growth. Now, as markets ebb and flow, remember: calm and chaos are two sides of the same coin. Keep a keen eye on your portfolio, tweak it like an artist perfecting a masterpiece. Stay nimble, stay smart. Your path to confident investing isn't just about reaching the end—it's about thriving every step of the way. So, take a breath, and take charge. Your financial future awaits!

0 Comments: