Introduction to Real Estate Investing

Real estate investing has long been revered as a cornerstone of wealth building and financial stability. It's a tangible asset class that offers potential for capital appreciation, passive income through rental yields, and diversification benefits for an investment portfolio. Unlike stocks and bonds, real estate is a physical asset that can provide utility and has intrinsic value. Historically, real estate markets have experienced a steady appreciation in value, contributing to its reputation as a safe haven for long-term investment.

However, diving into real estate without a solid understanding of the market can be akin to navigating uncharted waters. The real estate market is influenced by a myriad of factors including economic cycles, interest rates, demographics, and government policies, all of which can significantly impact the value of property investments. For new investors, it's crucial to grasp the fundamentals of the real estate market, such as the importance of location, the benefits of market research, and the impact of timing on buying and selling.

To illustrate the potential of real estate investing, let's consider some statistics: according to the National Association of Realtors, the median sales price of houses sold in the United States has been on a general upward trend, with a notable increase of 5.7% from 2019 to 2020. This trend underscores the growth potential of real estate as an asset class. Moreover, real estate investments have the added advantage of leverage, where investors can use various financing options to purchase properties, potentially increasing their return on investment through the use of borrowed capital.

In summary, real estate investing offers a unique blend of benefits that can enhance an investor's financial portfolio. It's essential, however, to approach this asset class with a well-informed strategy and a clear understanding of the market dynamics. By doing so, we can position ourselves to capitalize on the opportunities that real estate investing presents.

A graphic showing a house with upward trending arrows symbolizing investment growth.

A graphic showing a house with upward trending arrows symbolizing investment growth.

| Real Estate vs. Other Investment Options | Investment Type | Pros | Cons | Historical Returns |

|---|---|---|---|---|

| Real Estate vs. Other Investment Options | Investment Type | Pros | Cons | Historical Returns |

| Real Estate | Stable, tangible asset, potential for passive income, tax advantages | Requires management, higher entry cost, illiquid | Varies by location, generally averages 3-5% annually | |

| Stocks | High liquidity, potential for high returns | Market volatility, requires knowledge of market | Average annual return of 7-10% | |

| Bonds | Stable income, lower risk than stocks | Lower returns, interest rate risk | Average annual return of 2-3% | |

| ETFs | Diversification, lower fees, liquidity | Market risk, less control over individual investments | Depends on the type of ETF, generally follows market index |

Why Choose Real Estate for Your Investment Portfolio

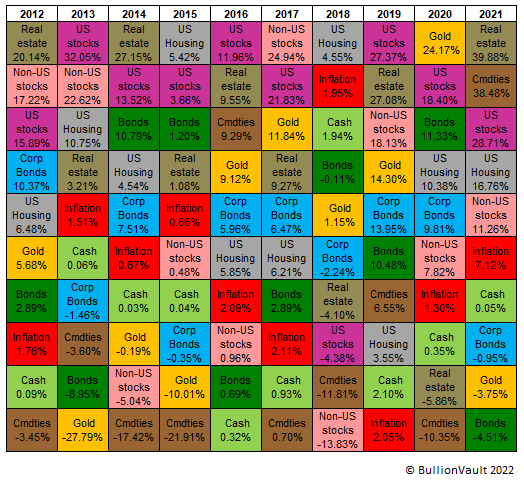

When we consider diversifying our investment portfolio, real estate emerges as a compelling option due to its relative stability and potential for appreciation. Unlike more volatile investments such as stocks, real estate typically experiences less short-term fluctuation and can provide a steady income stream through rental properties. The tangible nature of real estate also offers a sense of security that intangible assets may not provide. Furthermore, real estate values have historically increased over time, which can lead to significant capital gains for investors who are willing to hold onto their properties over the long term.

The addition of real estate to an investment portfolio can also serve as a hedge against inflation. As the cost of living increases, so too can rent and property values, which may provide investors with increased returns that keep pace with or exceed inflation rates. For instance, the U.S. Bureau of Labor Statistics reported that from 2000 to 2020, the Consumer Price Index for All Urban Consumers (CPI-U) rose by 50.1%, while property values in many markets increased by a greater margin during the same period.

When comparing real estate to other investment options such as ETFs, bonds, and stocks, it's important to consider the unique advantages and risks associated with each. ETFs offer diversification and lower costs but may still be subject to market volatility. Bonds provide more stable returns but often at lower rates, making them less attractive during periods of low-interest rates. Stocks can yield high returns but are also prone to sudden market swings. Real estate, on the other hand, provides a unique combination of stability, potential for passive income, and the opportunity for leverage, which can amplify returns.

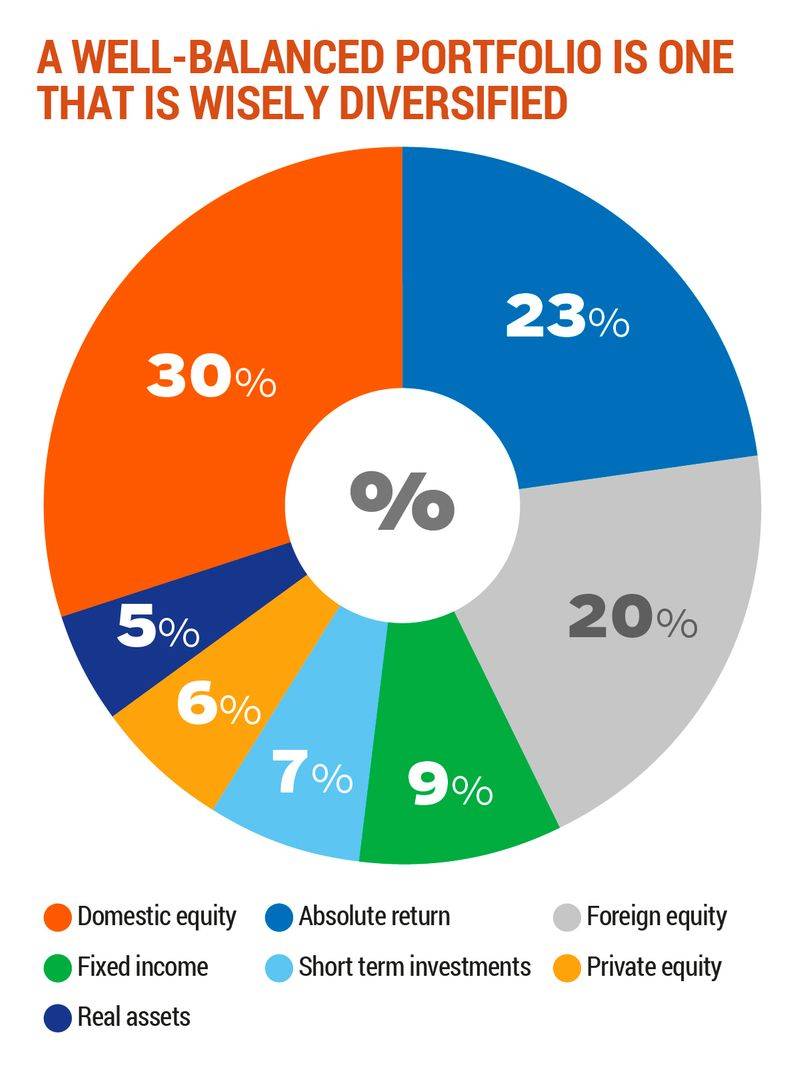

A pie chart displaying a diversified investment portfolio including real estate.

| Investment Comparison: Real Estate vs. Other Assets | Stability | Income Potential | Appreciation Potential | Inflation Hedge |

|---|---|---|---|---|

| Real Estate | High | High (through rent) | High | Strong |

| ETFs | Medium | Varies | Medium | Medium |

| Bonds | High | Low (fixed interest) | Low | Weak |

| Stocks | Low | High (dividends) | High | Medium |

Understanding the Risks Involved in Real Estate Investing

While real estate investing can be lucrative, it's not without its risks. One of the most common risks is market volatility. Although real estate is generally more stable than other investment classes, factors such as economic downturns, changes in interest rates, and fluctuations in the housing market can affect property values and rental income. For example, during the financial crisis of 2008, property values in many areas plummeted, which serves as a stark reminder that real estate markets can and do shift.

Another risk is liquidity. Real estate is not as liquid as stocks or bonds, meaning it can take longer to sell a property and access your funds. This can be problematic if you need to quickly release capital. Additionally, property investment often requires significant upfront capital, and there may be ongoing costs for maintenance, taxes, and insurance, which can impact the overall return on investment if not carefully managed.

To mitigate these risks, investors should conduct thorough market research, understand local market conditions, and have a clear investment strategy. Diversifying your real estate investments across different geographic areas and property types can also help spread risk. It's also wise to have a solid financial buffer to cover unexpected expenses or to weather periods when the property may be vacant.

Another strategy is to invest in real estate indirectly through Real Estate Investment Trusts (REITs), which allows investors to gain exposure to property markets without the need to directly manage properties. This can provide a more liquid form of real estate investment, with the added benefit of professional management.

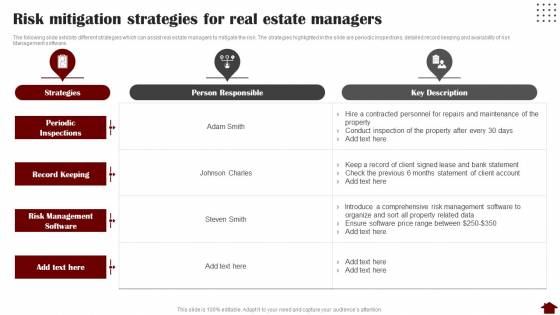

An infographic highlighting key risks and mitigation strategies in real estate.

An infographic highlighting key risks and mitigation strategies in real estate.

Risk Mitigation Strategies in Real Estate Investing

| Risk Factor | Impact | Mitigation Strategy |

|---|---|---|

| Liquidity | May take time to sell properties and access funds | Consider REITs for more liquid investments, maintain a financial buffer |

| High Upfront Costs | Significant initial investment required | Plan finances carefully, consider partnerships or crowdfunding |

| Ongoing Expenses | Maintenance, taxes, and insurance can reduce net income | Factor in all costs when calculating potential returns, set aside a contingency fund |

Getting Started with Real Estate Investing

Embarking on the journey of real estate investing can be both exciting and daunting for beginners. The first step is to educate yourself about the real estate market, investment strategies, and the legal aspects of property ownership. This foundational knowledge is crucial for making informed decisions and can be acquired through books, online courses, seminars, and networking with experienced investors. Understanding the basics of real estate transactions, property management, and the factors that drive property values will set a solid groundwork for your investment endeavors.

Next, it's important to assess your financial situation. Real estate investing often requires a substantial amount of capital, but there are strategies to start investing with little money. One approach is to look into real estate investment groups or partnerships, which allow you to pool resources with other investors. Another option is to consider real estate crowdfunding platforms, which enable you to invest smaller amounts of money in larger projects. Additionally, some government programs offer first-time investor incentives that can help with the initial costs.

Once you have a grasp on the basics and your finances are in order, it's time to define your investment goals and strategy. Are you looking for short-term gains through property flipping, or are you more interested in long-term wealth building through rental properties? Your goals will dictate the types of properties you should look for and the financing methods you might use. For instance, if you're aiming for long-term rental income, securing a mortgage with favorable terms will be a key step.

Finally, start small and choose your first investment property wisely. It's often recommended to begin with a single, manageable property that doesn't require significant repairs or renovations. This allows you to learn the ropes without becoming overwhelmed. As you gain experience and confidence, you can then consider expanding your portfolio to include more and diverse types of real estate investments.

A checklist or roadmap for beginners starting their journey in real estate investment.

A checklist or roadmap for beginners starting their journey in real estate investment.

Steps to Start Real Estate Investing with Little Money

| Step | Description | Benefit |

|---|---|---|

| Educate Yourself | Learn the basics of real estate investing and market dynamics. | Builds a strong foundation for making informed decisions. |

| Assess Finances | Review your financial situation and explore creative financing options. | Identifies your starting point and potential investment scale. |

| Define Goals | Set clear, achievable investment objectives. | Guides your property search and investment strategy. |

| Start Small | Begin with a manageable property to learn and grow. | Minimizes risk while gaining valuable experience. |

Types of Real Estate Investments

Real estate investments come in various forms, each with its own set of characteristics, benefits, and considerations. Residential properties, such as single-family homes, apartments, and condominiums, are the most common type of real estate investment. They can provide investors with a steady income stream through rentals and potential for appreciation. Commercial properties, including office buildings, retail spaces, and warehouses, typically involve longer lease agreements and can offer higher rental income, but they may also require more significant management and higher initial investments.

Industrial properties, such as factories, distribution centers, and storage facilities, are often characterized by even longer leases and can be less sensitive to economic downturns. However, they may be subject to specific market demands and require specialized management. Each of these property types has its own market cycles and factors influencing their performance, making it essential for investors to conduct thorough research and understand the market dynamics specific to the type of property they are considering.

For those looking for a more hands-off approach to real estate investing, Real Estate Investment Trusts (REITs) offer an alternative. REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. They allow investors to buy shares in commercial real estate portfolios and are known for providing high dividend yields. Additionally, REITs are typically traded on major stock exchanges, offering the liquidity that direct property investments lack.

According to the National Association of Real Estate Investment Trusts (NAREIT), equity REITs have provided an average annual return of approximately 9.72% over the past 20 years, which is competitive with other types of equity investments. This demonstrates the potential of REITs as a valuable addition to an investment portfolio, especially for those seeking exposure to real estate without the complexities of direct property management

.![]() Icons representing different types of real estate properties.

Icons representing different types of real estate properties.

Comparison of Different Real Estate Investment Types

| Investment Type | Income Potential | Management Intensity | Lease Length | Liquidity |

|---|---|---|---|---|

| Residential | Steady | Medium to High | Short to Medium | Low to Medium |

| Commercial | Higher | Medium to High | Long | Low |

| Industrial | Varies | Medium | Long | Low |

| REITs | High Dividends | Low | N/A | High |

Financing Your Real Estate Investment

Financing is a critical component of real estate investing, and there are multiple avenues available to secure the necessary funds. Traditional mortgages are the most common method, offering various terms and rates depending on your creditworthiness and the type of property you're investing in. Fixed-rate mortgages provide stability with consistent monthly payments, while adjustable-rate mortgages may offer lower initial rates that can change over time. It's important to shop around and compare mortgage options from different lenders to find the best fit for your investment strategy.

Real estate crowdfunding has emerged as a modern financing option, allowing investors to pool their money together to fund real estate projects. Platforms like Fundrise and RealtyMogul offer access to a variety of real estate investments with different risk and return profiles. Crowdfunding can be particularly attractive for those looking to invest smaller amounts of capital or diversify their investments across multiple properties.

Your credit score plays a significant role in real estate financing. A higher credit score can lead to better loan terms, including lower interest rates, which can significantly impact the profitability of your investment. It's advisable to review your credit report and address any issues before applying for financing. Financial planning is also essential; you should ensure that you have a clear budget and a plan for managing the investment's ongoing costs, such as property taxes, insurance, and maintenance.

Additionally, investors should consider the implications of leverage in real estate. Using borrowed capital can increase your potential return on investment, but it also increases risk. If property values decline or rental income decreases, you may still be obligated to make mortgage payments, which could strain your finances. Therefore, it's crucial to use leverage wisely and maintain a buffer to cover mortgage payments during unforeseen circumstances.

A flowchart showing different financing pathways for real estate investments.

Real Estate Financing Options Comparison

| Financing Option | Accessibility | Typical Interest Rates | Impact on ROI | Credit Score Influence |

|---|---|---|---|---|

| Traditional Mortgage | Widely accessible with varying terms | Depends on credit score and market rates | Can be significant, especially with leverage | High |

| Real Estate Crowdfunding | Accessible online, lower entry barriers | Varies by platform and project | Depends on project success and platform fees | Medium to Low |

| Adjustable-Rate Mortgage | Accessible, with variable rates over time | Lower initial rates, but subject to change | Can increase if rates rise significantly | High |

| Fixed-Rate Mortgage | Widely accessible, consistent payments | Higher initial rates, but stable over time | Stability can aid in long-term planning | High |

Building a Diversified Real Estate Portfolio

Diversification is a key principle in investment strategy, and real estate is no exception. By spreading investments across different types of properties and locations, you can reduce the overall risk of your portfolio. Diversification helps to mitigate the impact of a downturn in any single market or sector. For instance, if the residential market experiences a slump, having investments in commercial or industrial properties can help stabilize your portfolio's performance.

To achieve a well-balanced real estate portfolio, consider investing in a mix of property types such as residential, commercial, and industrial. Each type comes with its own set of demand drivers, economic sensitivities, and potential returns. Additionally, geographic diversification is important. Investing in different regions or cities can protect you from localized economic downturns. For example, a natural disaster in one area might depress property values there, but your investments in other locations could remain unaffected.

It's also wise to diversify within the same property category. For residential real estate, this could mean owning a combination of single-family homes, multi-family units, and apartment complexes. This approach can provide a buffer against market fluctuations that may affect one type of residential property more than another. The same concept applies to commercial and industrial properties, where diversifying across retail spaces, office buildings, and warehouses can provide additional security.

Another aspect of diversification is the inclusion of real estate investment trusts (REITs) or real estate mutual funds in your portfolio. These financial instruments allow you to invest in a broad range of properties without the need for direct management, and they can be more liquid than physical properties. According to a report by J.P. Morgan Asset Management, a diversified portfolio that includes REITs has historically provided better risk-adjusted returns than a portfolio consisting solely of traditional stocks and bonds.

)

)

A graphic illustrating a well-balanced investment portfolio.

Strategies for Diversifying a Real Estate Portfolio

| Diversification Strategy | Benefits | Considerations |

|---|---|---|

| Property Type Diversification | Reduces impact of downturns in any single property market | Requires knowledge of different property markets |

| Geographic Diversification | Protects against localized economic issues | May involve additional research into new markets |

| Category Diversification within Property Types | Provides a buffer against fluctuations affecting specific property categories | Can involve more complex management requirements |

| Inclusion of REITs and Real Estate Funds | Offers liquidity and exposure to a range of properties | Less control over individual investments |

Real Estate Market Analysis

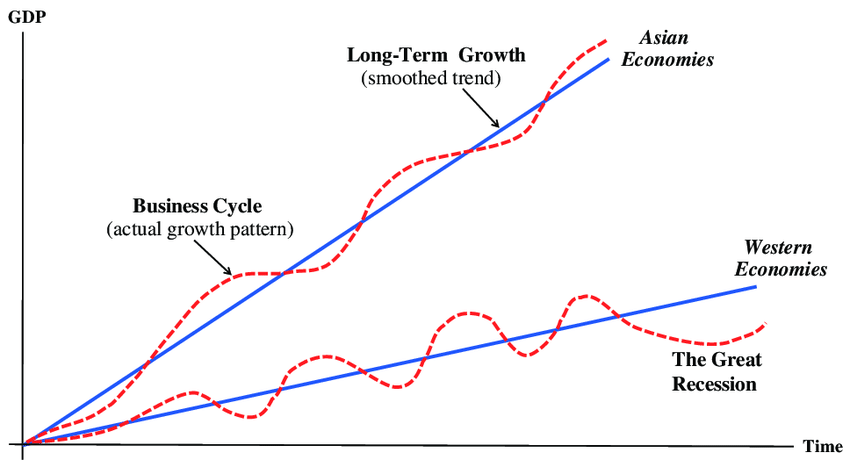

Conducting a thorough market analysis is essential for making informed real estate investment decisions. This process involves examining various economic indicators, understanding demographic trends, and assessing the supply and demand dynamics within the market. Key economic indicators to consider include employment rates, GDP growth, and interest rates, as they can significantly influence property values and rental demand. Demographic trends, such as population growth or shifts in age distribution, can also impact the types of properties that are in demand.

Location is often touted as the most critical factor in real estate. Properties in prime locations with access to amenities, good schools, and transportation tend to hold their value and attract tenants more easily. Conversely, properties in less desirable areas may have lower acquisition costs but could be harder to rent or sell and may not appreciate as quickly. It's important to research the specific area where you're considering investing, looking at factors such as crime rates, local development plans, and neighborhood stability.

Market trends can provide insight into the future direction of the real estate market. This includes tracking historical price movements, rental yield trends, and vacancy rates. For example, a low vacancy rate in a particular area may indicate a strong rental market, which could be a positive sign for investors looking to generate rental income. Additionally, understanding the current phase of the real estate cycle—whether it's in a period of expansion, peak, contraction, or trough—can help investors time their entry and exit from the market to maximize returns.

Real estate market analysis is not only about current conditions but also about forecasting future trends. Investors should stay informed about new infrastructure projects, zoning changes, and economic development initiatives that could affect property values. Utilizing tools such as real estate analytics software, attending local real estate investor meetings, and consulting with real estate professionals can all contribute to a more comprehensive understanding of the market.

[A map with various market indicators and trend lines](A map with various market indicators and trend lines.).

Key Factors in Real Estate Market Analysis

| Factor | Description | Impact on Real Estate |

|---|---|---|

| Economic Indicators | Employment rates, GDP growth, interest rates | Influences property values and rental demand |

| Demographic Trends | Population growth, age distribution | Affects types of properties in demand |

| Location Quality | Access to amenities, schools, transportation | Correlates with property value retention and tenant attraction |

| Market Trends | Price movements, rental yields, vacancy rates | Provides insight into market direction and potential |

| Future Developments | Infrastructure projects, zoning changes | Can significantly affect future property values |

The Long-Term Perspective in Real Estate Investing

Real estate investing is often viewed as a long-term endeavor, and for good reason. Unlike more volatile investments that can offer quick returns, real estate typically appreciates over time, providing the potential for substantial growth in the value of your assets. This growth is not just due to inflation but also to improvements in the property, changes in the local market, and the overall economic environment. For example, historical data from the Federal Housing Finance Agency indicates that home prices have increased by an average of 3.5% per year from 1991 to 2020, demonstrating the long-term appreciation potential of real estate.

When it comes to planning for retirement, real estate can play a pivotal role. Rental properties can generate ongoing passive income, which can be particularly valuable in retirement when you may no longer have a regular salary. Additionally, owning real estate provides a tangible asset that can be sold or leveraged if needed, offering flexibility in retirement planning. It's important to consider the timing of these investments, as the benefits of real estate are often realized over many years, making early investment advantageous.

To maximize the long-term benefits of real estate investing, it's crucial to maintain and improve properties over time. This not only helps to preserve their value but can also increase rental income. Furthermore, staying informed about market trends and being prepared to adapt your strategy as conditions change can help ensure that your real estate investments continue to perform well over the long haul.

It's also worth noting that real estate can be part of a broader retirement strategy that includes other investments such as stocks, bonds, and retirement accounts. Diversifying your retirement portfolio in this way can help manage risk and provide multiple streams of income. As with any investment, it's advisable to consult with financial advisors to tailor your real estate investments to your specific retirement goals and financial situation.

A timeline graphic showing long-term growth and investment maturity.

Benefits of Long-Term Real Estate Investment for Retirement

| Benefit | Description | Consideration for Retirement Planning |

|---|---|---|

| Appreciation | Gradual increase in property value over time | Can significantly boost net worth for retirement |

| Passive Income | Rental income provides regular cash flow | Supplements retirement income, reducing reliance on savings |

| Leverage | Ability to finance property purchases with debt | Can amplify returns but must be managed carefully to avoid financial strain |

| Liquidity | Option to sell or borrow against real estate | Provides financial flexibility in retirement |

Conclusion: Taking the First Step in Real Estate Investing

Embarking on your real estate investment journey is an exciting prospect that can lead to financial growth and stability. It's a path that requires diligence, research, and a willingness to learn, but the rewards can be substantial. As we've discussed, understanding the market, assessing risks, securing financing, and building a diversified portfolio are all critical steps in establishing a successful real estate investment career. Remember, every seasoned investor was once a beginner, and the key to their success was taking that first informed step.

To recap, start by educating yourself on the basics of real estate investing and the different types of properties available. Analyze the market to identify opportunities and understand the risks involved. Secure financing that aligns with your investment strategy and goals, and always keep a long-term perspective, especially if you're investing with retirement in mind. Diversification will be your ally in managing risk and ensuring a resilient investment portfolio.

Real estate investing is not a get-rich-quick scheme but a journey that can lead to significant wealth over time. With the right approach and mindset, you can build a portfolio that stands the test of time and provides you with financial security. We encourage you to take that first step today, armed with the knowledge and strategies you've gained. The world of real estate investing awaits, and the opportunities are plentiful for those who are prepared to seize them.

A motivational quote or image with a 'getting started' theme.

0 Comments: